The Good Work Plan – how will it affect you?

You may not have heard of the “Good Work Plan”, but this term stems from the independent Taylor Review of Modern Working Practices which the government commissioned as a result of major concerns regarding our existing employment legislation.

Several recommendations were made under the review, and the government have primarily accepted these. As a result, the Good Work Plan was formed.

So, what are the proposed Good Work Plan changes?

The following changes will all come into force on 6 April 2020 as part of the Good Work Plan:

Off-payroll working rules (IR35)

Significant changes are coming into effect next year, which changes the way private sector organisations determine the status of the off-payroll workers they engage. Only medium and large companies are affected, but it will now be their responsibility to determine the employment status of the individual they engage.

Watch out for our further updates on these changes coming soon, but you can read more here about the proposals and the implications of the IR35 transition period.

Written terms for all workers

All workers will have the right to a written statement of terms (currently this is only available to employees) and that this written statement must be given to employees on or before the first day of employment, rather than the current position of within two months of employment starting.

How can you prepare?

To ensure you are compliant with the Good Work Plan changes, we can review your existing employment contracts for a small fixed fee and advise you of any changes that need to be made. If you do not already have contracts of employment in place, we can discuss with you your business needs and prepare a template for existing and future employees. Send your existing contract template to us at [email protected].

Holiday pay

The reference period in determining an average week’s pay will increase from 12 weeks to 52 weeks (or the number of complete weeks for which a worker has been employed). This will ensure that workers who do not have a regular working pattern throughout the year are not disadvantaged by having to take their holiday at a quiet time of the year when their weekly pay might be lower.

How can you prepare?

You will need to analyse where employees regularly receive additional payments, for example, overtime, bonuses, commission, and whether these payments must be included in an employee’s normal pay, to ensure that when they are on holiday they receive consistent pay.

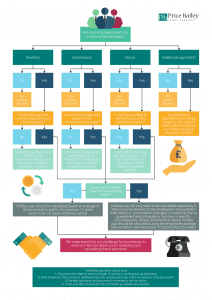

Download

We can provide you with a flowchart to help you in identifying any payments that need to be made. Download your holiday reference period flowchart here.

Information and consultation arrangements

Information and consultation arrangements give employees the right to be involved in workplace discussions about an agreed list of topics, such as redundancy proposals. Currently, support from at least 10% of the workforce is needed, and the new legislation will lower the threshold to 2% (subject to the existing minimum of 15 employees) as the government believes high levels of employee engagement improve organisational performance and productivity.

How can you prepare?

If you are planning any changes in your workplace after the 6 April 2020, contact us using the form below to discuss your obligations as an employer.

Agency workers’ rights

Currently, after 12 weeks of service, an agency worker is entitled to receive the same level of pay as a permanent worker unless the agency worker opts out of this right and instead elects to receive a guaranteed level of pay between their temporary assignments (“Swedish Derogation”). From the 6 April 2020, the opt-out will be removed so that all agency workers will have a right to pay parity after 12 weeks.

How can you prepare?

Review how you use agency staff and make provision for a potential additional cost to the business. If you have any concerns about how these changes may affect you, please contact us using the form below and we can discuss your obligations with you.

Key facts for agency workers

All employment businesses will be required to provide agency workers with a Key Information Document, which must contain certain prescribed information.

How can you prepare?

We can assist you in the preparation of a template Key Information Document in advance of the changes coming into force on 6 April 2020. Contact us using the form below if you would like to discuss your obligations.

Other announcements relating to the Good Work Plan.

The new Good Work Plan legislation does not stop there and the following changes will also be implemented in the future. Keep your eyes peeled for our future announcements on when the following changes will take effect:

- The right to request a more predictable and stable contract – this new right will mean an employee can request a more predictable and stable contract after 26 weeks of employment. It is expected that this will work in a similar way to a flexible working request.

- Break-in continuous service – it is proposed that a break in employment will be extended from one week to four weeks enabling those who work on a more sporadic basis to qualify for more employment rights.

- Tips and gratuities – tips will need to be given to the individual rather than being taken by an employer.

- Employment status tests – new rules will come into force to enable more clarity over establishing employment status but it remains to be seen how this will be done.

- Naming and shaming – employers who do not pay the compensation awarded at an employment tribunal following a successful claim will face being publicly named and shamed.

- Umbrella companies – the Employment Agency Standards Inspectorate (EAS) exists to enforce agency worker rights. Its future remit will be expanded to allow it to cover umbrella companies too.

- State enforcement of holiday pay – Currently, when an employer does not pay holiday pay correctly, the individual has to bring employment tribunal proceedings. In the future, there will also be a state-led enforcement regime to assist vulnerable workers (although we wait to see who will be categorised as “vulnerable”).

With a multitude of changes coming your way, contact us below to discuss how you can get ready for 6 April 2020 and the Good Work Plan.

This post was written by Price Bailey. If you would like to know more then please contact any of the Legal team using the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

Have a question about this post? Ask our team…

We can help

Contact us today to find out more about how we can help you