Fixed assets, capitalisation & maintaining the fixed asset register

As a school business leader in an academy trust you have to wear many different hats. For many who find themselves in the role of Chief Financial Officer for an academy and do not have a financial accounting background this can present many challenges. One of the least familiar areas for someone without a financial accounting background is often the subject of fixed assets.

Until 2020 it was not un-common that some of our academy clients would leave making fixed asset adjustments until preparing for the year-end audit. Some would rely on the auditor to identify any assets and suggest the necessary adjustments, this often resulted in the trust not having a fixed asset register. This was something “the auditors do”. That however changed from 1 September 2020 when the Academy Trust Handbook, known at the time as the Academies Financial Handbook, stated for the first time in section 2.7 that “The control framework must manage and oversee assets, and maintain a fixed asset register”.

What does this mean?

Whilst there is limited detail in the Handbook and the wording has not changed since its inception 4 years ago, the expectations are clear. An Academy Trust must have its own fixed register and keep it up to date alongside the accounting system. Failure to properly maintain the fixed asset register is likely to result in a high priority management letter point. Your fixed asset register must always agree to your accounting system.

What is a fixed asset register?

You may have a list of assets owned by the trust, otherwise known as an inventory listing, this is used to keep track of assets held and where they are located but is not a fixed asset register. A fixed asset register is specific to a financial year and is a breakdown of the fixed asset note in the accounts, it records the value of each asset reported on the balance sheet. The value is made up of the cost (usually purchase price) and how much they have subsequently been depreciated by (the value lost each year to usage and obsolescence). Whilst these items would all appear on your inventory listing, not all of the items on your inventory listing would appear on the fixed asset register. For example, if your capitalisation policy is £10,000 and you spend £5,000 on laptops, you may choose not to capitalise these on the balance sheet and account for them as revenue expenditure. You still need to control these expensive assets and they should still be on your inventory listing, but as they have not been capitalised on the balance sheet, they will not be included on your fixed asset register.

What counts as a fixed asset?

The Financial Reporting Standard (FRS 102) under section 17 states that items should be capitalised when “it is probable that future economic benefits will flow to the entity and that the cost of the item can be measured reliably”. For example, if you were to purchase a new demountable classroom this would be to last for a number of years during which it will generate government funding for the trust. Rather than a large one-off cost in the year of purchase it is instead recognised on your balance sheet as an asset you own, and only a proportion of the purchase price is accounted for as a cost each year as the asset is depreciated. Rates of depreciation are subjective, can be different for each type of asset and are stated in the trust’s accounting policies in the audited financial statements.

It is obviously not practical to capitalise every item of expenditure that meets this definition, and the more you capitalise the more unwieldy your fixed asset register becomes. Your financial regulations should therefore include a policy as to what minimum level of expenditure you will apply depending on the size of your trust (i.e. your capitalisation limit). You should keep this under review as to what is an appropriate level for your Academy Trust. Typically, we see limits from £1,000 to £10,000.

What should we capitalise?

Electronic equipment like laptops for example are commonly purchased and would always meet the definition for capitalisation, but these items are usually individually below a Trust’s capitalisation limit. However, they are often bought in bulk with the total price exceeding the capitalisation limit. Where this is the case, these items should be capitalised on the balance sheet.

Generally, replacement assets should not be capitalised, for example if you have a Condition Improvement Fund (CIF) project for roofing works, assuming you had a roof before and you still have one after it would be appropriate to put the costs through revenue expenditure.

Whilst there is no black or white answer, as a rule of thumb, if an asset is brand new, you didn’t have it before, and it is not a repair it should be capitalised. If you are a Price Bailey client, you can always use our free helpdesk to check on particular circumstances.

Does choosing whether we capitalise an asset or not affect our reserve levels?

In short – no. Whilst capitalising an asset reduces your expenditure and in theory therefore increases your reserves carried forward,. When analysing your funds at the end of the year in the accounts we have to show where a fixed asset was funded from, and this will reduce the reserve to the same value as it would have been had the asset not been capitalised. This can be shown in the example below:

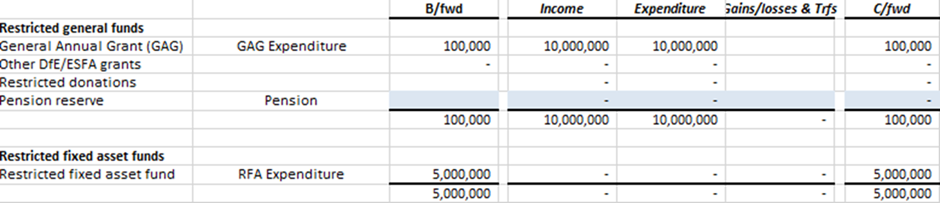

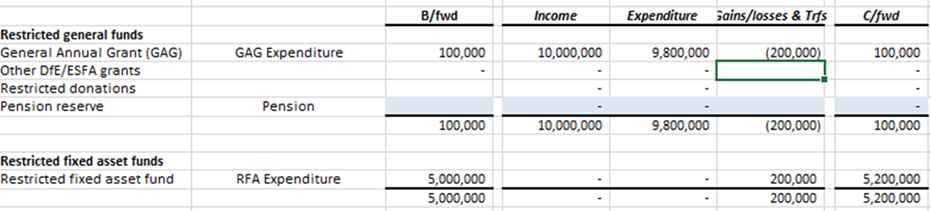

Price Bailey Academy Trust has fixed asset reserves brought forward of £5m and GAG reserves of £100k. It has spent £200k on replacing the heating system this year which was funded out of GAG reserves, it has currently not capitalised this and the cost is within its expenditure of £10m. The funds working therefore looks as follows:

If it chooses to capitalise the heating system, expenditure will reduce by £200k. The fixed assets are now worth £5.2m (which are not included in your GAG reserves) and a transfer needs to go into restricted fixed assets from where the asset was funded, which in this case is GAG. Thus the GAG carried forward remains the same.

What should my register include?

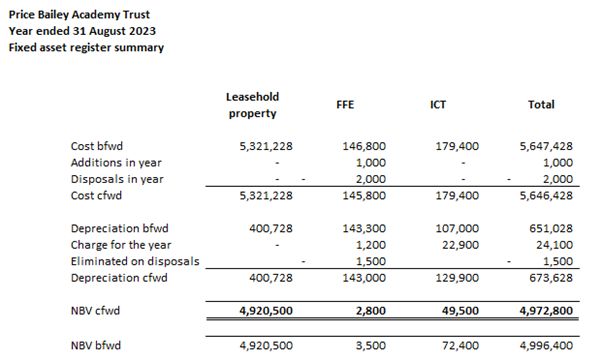

Your register should have 2 sections to it – a summary providing totals for each asset category and a detailed breakdown of those totals showing the split each asset. Your summary will be an exact replica of what will appear in the accounts and should look something like this:

What the asset categories are in the columns will depend on your unique circumstances and how you choose to categorise assets, the 10 rows are essential and should be on all registers. Assets are split between their original cost and the depreciation charged to them, the cost less depreciation then results in what their value in the accounts known as Net Book Value (NBV) is.

The cost and depreciation brought forward figures during the year must never change and must equal the carry forward values from the preceding year. In the instance of the example above for the year ended 31 August 2023 the figures in the cost brought forward and depreciation brought forward will be exact matches of the cost carry forward and depreciation carry forwards in the 31 August 2022 signed accounts. Any assets bought in the year will be included as additions. Should any asset be disposed of in the year, either because it is sold or more likely it is no longer in use and scrapped, the original cost of the asset is included as a negative entry in disposals to bring the cost carried forward back down. The same is true of the corresponding depreciation that had been charged on that asset up until the date of disposal, this goes in the eliminated on disposals line to bring the net book value of the asset disposed down to zero. The difference between the net book value at the time of disposal and what it was sold for will be recorded as a profit or loss on disposal as a revenue item (sometimes referred to as the P&L).

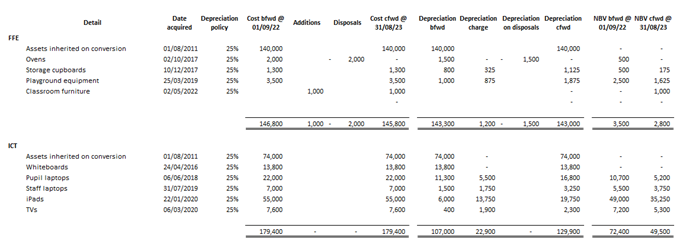

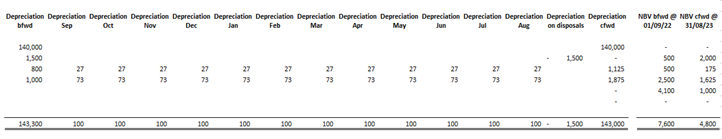

The detailed breakdown of assets will show each of those 10 row headings for each and every individual asset, as there are likely to be many assets it is normally sensible to show what were the row headings in the summary as columns and show each individual asset on its own row. A simple example of what this might look like is below:

As above when an asset is disposed of, the cost and depreciation are reduced to nil using the disposals and depreciation on disposals columns. It is vital when you dispose of an asset on the register that you do not delete the line as this will amend the brought forward figures and they will no longer agree to the prior year accounts. Only once we are into the financial year after the year of disposal should the asset no longer appear on the register.

The above example shows one column for the depreciation charge for the year, if you are processing it monthly you may find it easier to have 12 columns to show the depreciation each month.

Depreciation should be charged in line with the useful economic life of assets as stated in your financial regulations. For example, you may decide to depreciate computer equipment over 5 years in which case 20% depreciation will be charged each year.

What do I do with my fixed asset register when the new financial year starts?

At the start of your new financial year assets that you had bought in the previous year are no longer additions, assets you disposed of are no longer there and your carry forward figures become brought forward figures. You will need to roll forward your register into the new financial year. This can be simply done by copying your carry forward figures into the brought forward column, clearing out the additions, disposals and depreciation charge in the year figures and removing the disposed assets which now have nil cost. It is important when doing this to start with the depreciation carried forward. The reason for this is the depreciation charge figures will often be driven by a formula and if you change the cost figures first this could amend the depreciation charge and then the carry forward figures you copy into the brought forward column may not be right. You can simply check whether your roll forward has been done correctly by checking the brought forward totals against the signed accounts. It is important however to remember that your August year end audit will be happening after the new financial year starts and adjustments to fixed assets could arise as a result, therefore it may be sensible to hold off preparing the roll forward until the audit is complete.

It is important to note that you may in the previous year have fully depreciated an asset such that its Net Book Value has now reduced to nil, this does not mean that you should now remove it from your register, if you still have it it should stay on the register showing its cost and depreciation figures and will only be shown as disposed when you no longer have the asset. You should review your register regularly for old assets you may not have anymore. For example, you might have some computers that are years old that you have scrapped.

Frequently Asked Questions

Q: I’ve received an ESFA capital grant, do I have to capitalise the expenditure?

Not necessarily. In addition to the purchase of assets any sort of work to your assets, particularly your buildings (generally known as repairs), fall under the definition of what the ESFA will provide capital grants for. For example, it is common to receive CIF bids for repairs to pipework or replacement windows. Generally, these are repairs to existing assets and should not be capitalised. If you had windows before and you still have windows now no new asset has been created.

Q: How do academy trusts account for donated items, such as laptops?

Sometimes you will have assets donated to you that you have paid no consideration for, in this case you will need to determine the value of these assets (estimated value on the open market) and whether they meet the criteria under your policy for capitalisation. For example if you are donated £10k worth of laptops and your policy is to capitalise assets over £5k you would need to recognise a donation (income of £10k) and capitalise the asset as a fixed asset addition. The journal in your system would be debit fixed assets and credit income, even though no cash transaction has taken place.

Q: We have been donated laptops to donate to our students, should these be on our register?

If you have passed ownership on to the students then no, only assets you own should be on your register. In this case you would recognise an income donation receiving the laptops, and an expenditure donation to pass them on.

Q: Do we need to process depreciation monthly?

This will depend on whether your Trustees want this information in the management accounts. Establish this with trustees if you have not already. Whether your depreciation is posted monthly or not, your register still needs to be maintained throughout the year.

Q: What happens when we sell an asset?

The difference between the value you sell for and the net book value being written off will be a profit or loss on disposal, which should be treated as an expenditure item similar to depreciation. This should have its own nominal code. Remember that you may need to obtain secretary of state approval to sell an asset which has been funded using a central government capital grant.

Q: What happens when a school converts to an academy?

When a new school converts to an academy and joins your Trust you will receive all its assets “donated” to you. Similar to the above, values will need to be placed on these and they will be treated as a donation in kind (shown as assets on conversion). In this case your capitalisation policy is not relevant and these are material by nature regardless of value.

Q: Which value should we recognise when receiving assets from an acquired school, the net book value or the original cost?

Net Book Value. You are receiving the assets at their current value, therefore the acquisition cost for your trust is the net book value from the school you are receiving them from.

Further support

If you would like support, advice, or have any further questions regarding this article you can contact our team using the form below.

If you would like the full recording of our recent fixed asset workshop, please get in touch. Alternatively, our team are on hand to help answer any queries you should have

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Have a question about maintaining fixed assets? Ask our team…

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

We can help

Contact us today to find out more about how we can help you