Cash flow management considerations for charities

Cash in the bank (rather than the SOFA or balance sheet outlook) is king in order to ensure an organisation has the resources to continue to settle their liabilities as they fall due, and ensuring they can continue operationally. The liquidation of The Kids Company in 2015 serves as a useful reminder of the importance of cash to a charity as ultimately, running out of cash is what causes most charities to fail. As we approach a transitional time of year for budgets and forecasts to be prepared we thought we would provide some tips on cash flow management.

The COVID-19 Pandemic is continuing to have a profound effect on the UK economy, and with government support schemes such as the Coronavirus Job Retention (furlough) scheme tapering to a close, cash flow issues could arise for charities in the near future if cash is not effectively managed. In times of uncertainty, some charities may have cash or investment funds built up as a contingency. The trustees however will need to consider the length of time such funds can sustain the charity, and the proportion of such funds that are considered ‘free’ i.e. liquid and unrestricted in nature.

Managing a charity’s finances

Charity Commission guidance CC12 ‘Managing a charity’s finances: planning, managing difficulties and insolvency’ states that budgets need to be produced at least annually, but more frequently if the financial climate makes it necessary. During times of uncertainty we would recommend budgets and forecasts be reassessed on at least a quarterly basis. Cash flow forecasts provide clarity as to liabilities due in the short term, and can show if the charity is in danger of running out of cash. If the charity identifies they are in danger, the forecast can locate when this is most likely to occur, and enable the trustees to take decisive action before it is too late.

A cash flow forecast helps the charity focus on its cash levels and to prepare a strategy going forward based on the findings, as well as helping to find ways for the charity trustees to bolster and control cash balances in the short term if required. The conclusions of the forecast may deem it necessary for the charity to liaise with key stakeholders (perhaps significant grant funders), who may approve the charity to spend restricted funds received on unrestricted expenditure in the short term to ensure the charity’s survival. If additional funding is required, forecasts are usually a prerequisite prior to approval, while the preparation of detailed forecasts will help to build further credibility with funders.

What information is required?

Any forecast is only as good as the information fed into it and the quality of the assumptions used. When considering what information is required and how to populate the forecast, it’s worth starting from the latest set of financial statements and available management accounts, while a peruse of the charity’s bank statements for the previous 3 months will help ensure all potential income and expenditure streams are considered.

Ultimately, any source documentation or information that will affect future cash inflows or outflows should be considered. If your charity uses a cloud based accounting package then it may be quicker to locate such information, however many charities prepare forecast models using Excel. The key focus tends to be on the following:

- forecasts for each income stream,

- the likely timing of receipt of such future income and;

- the timing of future expenditure, including aged creditors and amounts due to HMRC.

If staff costs make up a significant proportion of total costs, access to the latest payroll reports will also be useful. It is important to factor in the timing of any payments such as payroll, rent etc. into such forecasts, to ensure the assumptions are as reasonable as possible.

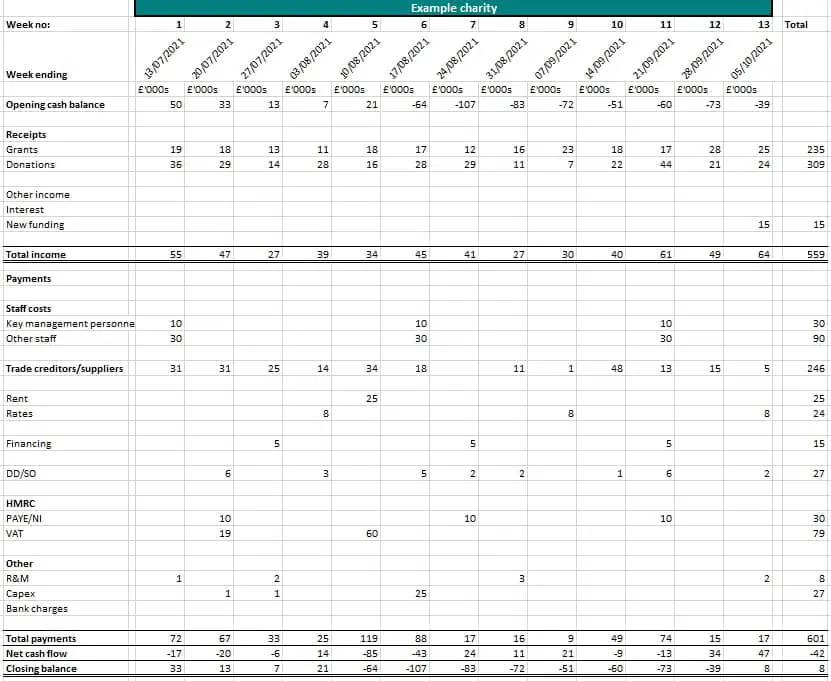

Please see an example below of a 3 month (13 week) cash flow forecast. The opening balance should be obtained from bank statements, while each tab populates and breaks down the data gathered from source documentation. All of the totals from the relevant tabs should then feed into the summary tab to provide an instant overview of all cash inflows and outflows, while charts or diagrams can be created to quickly summarise the forecast findings.

The example below shows that if no action is taken, and all of the assumptions are correct, the charity will be in its bank overdraft from weeks 5-12. The charity can therefore pinpoint their key funding requirements, and make decisions such as agreeing payment plans with some creditors, stopping non-essential expenditure, deferring project costs until funds allow, or deferring the purchase of capital expenditure, to ensure the charity remains operational.

Further forecasting considerations

Some costs exist which a charity can control, while some will be completely out of their control. It is therefore worth scenario planning where possible, i.e. undertaking an element of sensitivity analysis in case unexpected costs arise within the 3-month period. It is up to the Trustees and management to agree on the frequency of such forecasts, and management to explain any adverse variances between actuals and forecasted items.

If the forecast indicates that significant cash flow issues are likely to arise, it will be the responsibility of the trustees to formulate a strategy to safeguard the charity. They may consider the following:

- arranging more frequent trustee meetings;

- urgent appeals to funders or diversifying existing income streams;

- government support;

- additional cost controls;

- cost reductions such as redundancies, or eliminating non-essential, non-value-adding, discretionary expenditure;

- operational change, or;

- asset disposals/refinancing

Final considerations

Some finance personnel may find producing budgets, forecasts, variance analysis etc. on a regular basis time-consuming, and some charities may struggle to prepare and reanalyse on a timely basis due to constraints of resources. In spite of the time constraints, the above summary has highlighted the importance for charities to prepare regular cash flow forecasts as part of their reporting to the Trustees. The Charities Commission expects Trustees to regularly assess and monitor the overall financial position of their charity, and to take steps where necessary to ensure that its funds can continue to be used for the purposes for which they were given.

This article was written by Simon Rowley, If you would like to discuss any of the issues raised above, please contact Simon using the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

Have a question about this post? Ask our team...

We can help

Contact us today to find out more about how we can help you