Close companies: Directors loan or dividend - What's the better option?

For many owner-managed businesses, particularly ‘close companies’ – companies that are privately owned by five or fewer ‘participators’ (which, broadly speaking, means anyone with a financial interest, usually shareholders or directors) – deciding whether to take money out of the company via a loan or dividend may be less than straightforward.

There has been a rule in place for some time to deter director shareholders paying themselves via loans (which in some cases are not repaid) instead of taking dividends or salary, and in the process reducing their tax burden.

The rule states that if a close company lends money to a participator, any debt still outstanding nine months from the end of the company’s financial year triggers a corporation tax charge, known as s.455 tax. This tax charge was previously 25% of the loan owing, but as of April 2016 it increased to 32.5%. If the loan is later repaid, the company can then apply to get this tax back nine months from the year end in which the repayment is made.

Despite these changes, some businesses have continued to go down the route of director loans, either as part of a planned payment or because the financial discipline within the business is not as strong as it should be. So is this ever a sensible or tax efficient choice for companies – and what issues should business owners take into consideration before deciding on loans or dividends?

What are the tax implications?

While tax is far from the only consideration, it is one that, rightly or wrongly, often sways the decision maker. So if it is a straight choice between a dividend payment or a loan, you need to know the marginal tax rate of the participator – and remember, the cash out may itself change that rate.

The easiest scenario is basic rate taxpayers, for whom a dividend is always preferable to a loan.

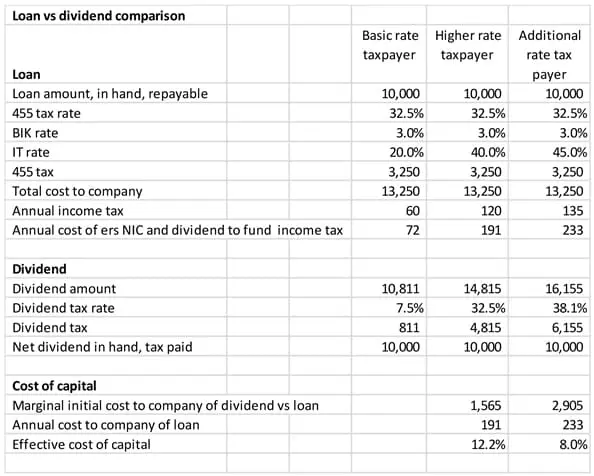

But for higher and additional rate taxpayers, the tax situation is slightly more complex. A loan can initially be cheapest, as the s.455 tax rate of 32.5% is on a par with the dividend rate for higher rate taxpayers, but less than the 38.1% income tax rate charged to additional rate taxpayers. The s.455 tax also falls on the company, whereas the dividend tax falls on the participator, so the s.455 tax take is always less than the equivalent dividend tax take for all but no or basic rate taxpayers.

Most participators will also face a ‘benefit-in-kind’ (BIK) tax charge on any loan, which they will then pay through their self-assessment tax return. This annual income tax on the loan should be regarded by the participator and the company as the price to be paid for the lower initial tax. The effective costs to the company (assuming it agrees to meet the cost) are 12.2% for a higher rate taxpayer and 8% for an additional rate taxpayer.

These rates may seem high, but many businesses can generate marginal returns which exceed these levels; if they can, a loan is preferred to a dividend, but if not, then dividend will be the better option.

What other issues need to be considered?

If the plan is to repay a loan in the short term, there may not be any s.455 tax to pay if you get the timing right; in such situations a loan is probably the right course of action.

Alternatively, you may be intending to clear the loan when the financial situation improves. In that case, the s.455 tax can eventually be reclaimed, and the extra tax paid to bring the annual BIK tax cost to an end. But if this is the intention, it’s important to take into account the impact of making the loan on the company’s accounts, and on any trading status of the company.

The uncertainty of future financial movements should also be considered. Unpredictable tax and interest rates may impact on loan decisions throughout the life of the loan, but they won’t affect dividend decisions which are final. Rates could go for or against you, and may be within your control (for instance if a change of circumstances is imminent) or not.

It’s also important to think about governance issues – is the dividend or loan legal in the first place, what should be done to make it legal, and what documentation is required? How will you deal with unequal or disproportionate interests of participators and other stakeholders?

If the company is at any risk of insolvency – and disregarding the question of whether, in such circumstances, the company should be making any payments to participators – it should be remembered that while dividends may be repayable within two years, loans will definitely be repayable. It could leave you in the incredibly difficult situation of, after watching your life’s work and source of income disappear, then having to repay a ‘loan’ that was consumed long ago. Finally, consider personal income issues. Most people need an income to live off, so indefinitely living off loans is sustainable only by the very few.

Q: Should I take a loan from my company or a dividend?

It depends, but if it’s only tax you are mostly concerned about then here are your general options:

- If you don’t pay tax or are a basic rate taxpayer, then in most cases it is better to take a dividend

- If you are a higher rate tax payer and can make more than 12.2% on your money, then you might be best taking a loan

- If you pay tax at the highest rate and can make more than 8% with your money, then a loan may be a better option for you.

As always, don’t let the tax tail wag the commercial dog. The table below highlights some of the key tax figures in relation to loans and dividends, but it ignores much of the wider detail – and it’s these wider issues which are often far more important than the narrow comparison of cash flows, tax and interest rates.

This post was written by tax specialist and Partner, Charles Olley. If you would like further information on our tax services or for any help please use the form below.

This post was written by tax specialist and Partner, Charles Olley. If you would like further information on our tax services or for any help please use the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

Have a question about this post? Ask our team…

We can help

Contact us today to find out more about how we can help you