A demerger overview: considerations, advantages and complexities

A demerger is a type of corporate restructuring process whereby a business, a company or a corporate sub-group is split into two or more separate corporate groups.

There are many commercial reasons that company directors and shareholders choose to demerge businesses from the wider corporate group. The resultant companies are typically owned by the same shareholders as the original company, although ownership can be distributed differently among the shareholders.

For a tax efficient demerger, HMRC will need to be satisfied that the demerger is being undertaken for genuine commercial purposes and not with a tax motive.

Why should you consider demerging?

-

Rapid growth

If a company/group has grown rapidly, and without much planning, in order to optimise the management of different business activities it may be more efficient to separate the different businesses into separate entities.

-

Exit planning

If there is an appetite to sell the company/group in the future, demerging any unwanted companies/trades/investment businesses from the Target company prior to sale could result in the sale being more attractive to a potential buyer. Please refer to example 1 for further detail.

-

Succession planning

Sometimes, we see shareholders want to leave interests in different trades of a company/group to different people. Separating the interests into varying corporate groups is one way to achieve this.

-

Partitions

Occasionally, shareholders seek a demerger following a shareholder dispute or divorce. In these situations, it is common for the shareholders to also be directors, and allowing them to pursue their distinct business interests can be preferable for everyone involved. An example of this type of demerger can be seen in example 2 below.

-

Mitigating operational trading risk

By ring-fencing a higher risk trade from a trade/investment business carrying less risk, the risks associated with the higher risk trade will be isolated, which could be vital for trades/investment businesses which pose a significant threat to the entire company.

-

Share schemes and incentives

If the directors want to operate share schemes (such as the EMI scheme) to incentivise key employees, however only want to issue shares to employees in the trade in which they work, then separating trades into different corporate groups would provide the flexibility to achieve this.

-

Other advantages of demerging

The process of splitting up a company allows businesses and shareholders to enhance their focus and efficiency by permitting each new entity to concentrate on its core business, in addition to providing clearer accountability and simpler management structures.

From a tax perspective, demerging can allow for optimisation of tax management and consequential reduction of overall tax liabilities. Utilising one of the demergers below enables directors and shareholders to achieve their commercial objectives in a tax efficient way, and without crystalising unexpected significant tax liabilities.

Example 1 – demerger

Referring to the image below, Company ABC Ltd is owned by a group of shareholders but has two different trades (Trade A and Trade B), or a trade and investment business (Trade A and investment business). A demerger could see that Company ABC Ltd is separated to form two separate corporate groups – Company A Ltd and Company B Ltd. In this case, Company A Ltd owns and operates Trade A, and Company B Ltd owns and operates Trade B (or the investment business). The shareholders of Company A Ltd or Company B Ltd are identical to the shareholders of the previous company ABC Ltd .

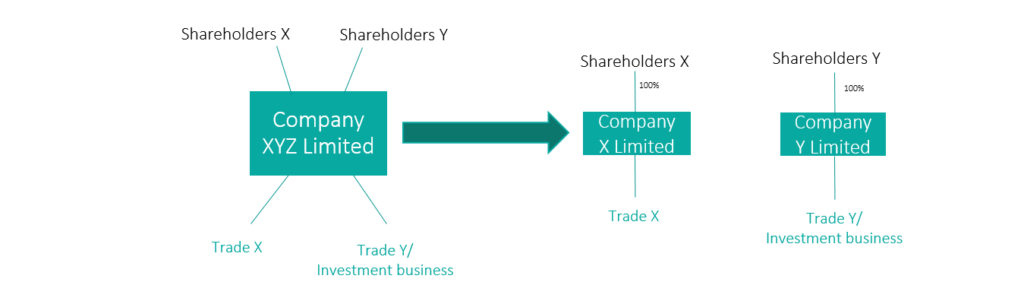

Example 2 – partition demerger

A partition demerger can be seen in example 2. Company XYZ Ltd operates Trade X and Trade Y (or Trade X and investment business), and is owned by shareholders X and Y. A partition demerger would see that Company XYZ Ltd is split to form two new corporate groups – Company X Ltd and Company Y Ltd. Company X Ltd would own Trade X and Company Y Ltd would own Trade Y (or investment business), with Company X Ltd being owned by Shareholders X and Company Y Ltd being owned by Shareholders Y.

The difference between a partition demerger and a regular demerger, in their most basic forms, is that a partition demerger will see ownership of the original company divided amongst distinct shareholder groups, typically leading to the formation of new corporate companies controlled by these groups. Shareholder disputes is a common reason, amongst other reasons, for partition demergers to occur.

While the above examples illustrate demergers in their simplest forms, it is important to note that demergers can involve significantly more complex structures and considerations, such as the allocation of assets and liabilities, regulatory approvals, and the establishment of independent management teams for each new group, all of which add layers of intricacy beyond the fundamental process of separating a company into new distinct parts.

What are the types of demergers?

-

Statutory Demerger

The criteria to undergo a statutory demerger is stricter than other types of demergers. For starters, those companies who are wishing to separate a trade and an investment business would not meet the conditions to undergo a statutory demerger. This is because to make use of this type of demerger a company must only have two (or more) trades. In addition, a statutory demerger cannot be completed in anticipation of sale.

Statutory demergers can also be structured in different ways depending on the specifics of the transaction and the objectives of the entities involved. There will also be a need to consider certain events within 5 years of a statutory demerger which may result in a tax charge.

There are two different types of statutory demergers: indirect and direct.

s110 is a reference to legislation found in the Insolvency Act 1986 which allows a company to split in two in a tax neutral way. It involves a liquidator striking off the existing company belonging to shareholders, and forming two new companies owned by the same shareholders. Companies that operate a trade and investment business, trade and property business, or multiple trades, would be able to consider this option.

The liquidator is essential to the process, and it is a requirement that the liquidator is licensed to act as such. There are a lot of considerations pre-liquidation that need to be taken into account, which if not dealt with can slow down the process, especially if there is a tight deadline.

Read a more comprehensive overview of s110 demergers in our recent article.

This process sees a company reduce its share capital whilst simultaneously demerging the whole, or part, of a business into a separate entity. This involves cancelling a portion of the company’s shares, distributing shares of the new entity to existing shareholders, and creating an independent company that inherits specific assets and operations. Regulatory and tax considerations are crucial in such transactions. This process is appropriate for trade and investment business, trade and property business, or multiple trades.

Read more about capital reduction demergers in our recent blog, plus you will also be able to watch videos explaining the process too.

What are the tax considerations?

Using the examples above, Trade B, Trade Y or the investment business could simply be sold to the new corporate entity without any tax planning. This could give rise to several different immediate tax liabilities including, Corporation Tax, VAT, Stamp Duty Land Tax (SDLT) and Stamp Duty on shares. The tax efficient demergers described above enable a commercially motivated demerger to be undertaken with minimal, or no, immediate tax liabilities.

Why are these demergers so complex?

A tax efficient demerger process is an intricate one which contains many steps. These steps require careful considerations for the varying taxes that may be applicable and their corresponding implementation paperwork. Sometimes demergers may be occurring due to shareholder disputes, which can cause strain on parties involved and often see multiple sets of solicitors and accountants working the demerger.

All the steps involved within a demerger are equally important, including from a legal and tax perspective. We strongly recommend that clients seek clearance on any type of demerger to obtain more certainty around the tax implications of demerging, and experts within this field can support with claims for the type of tax relief which will be required e.g. SDLT or Capital Gains Tax (CGT).

There are also costs as a result of demerging to consider, including increased compliance costs, potential taxation on the transfer of assets during the transaction, and the loss of group relief.

Closing thoughts

The various types of demergers can offer flexibility depending on a company’s goals and circumstances, and throughout the process it is important to bear in mind why your company is choosing to demerge in the first place. Demergers can offer significant advantages, however, require careful planning from professionals to strategically minimise the liabilities for all involved.

How we can help

Charlotte has worked on numerous complex advisory projects, and has experience with varying types of demergers, including reduction of capital, s110 and partition demergers. She has worked on demergers in a multitude of different situations including pre-sale, separating trades to operate more efficiently and mitigate risk, divorce settlements and disputes – to name a few!

Depending on the commercial reason and type of demerger, our Tax team also work closely with our SCF team should the process require a company valuation, in addition to our Insolvency team in cases of liquidation demergers. If you are undergoing a demerger our Tax team will also produce a comprehensive tax report which describes each step in detail, along with the tax implications for the different parties involved in each step. You will be able to keep this document as a record. We will also draft the clearance application based on your commercial rationale.

At Price Bailey, we invest the time needed to fully understand your concerns, obstacles, and opportunities – time we don’t charge you for.

Have a question about this post? Ask our team...

We can help

Contact us today to find out more about how we can help you