There are a number of reasons why you may require an audit or assurance report. Whether to meet your compliance requirements, provide assurance to investors, or review your processes and controls, they can sometimes be seen as an interruption to your business.

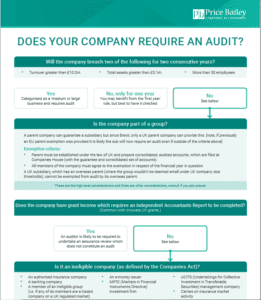

The government recently announced that the audit thresholds above which an audit is a legal requirement will be set to increase for financial years starting on or after 1 October 2024. The current* threshold limits state that an audit is not required for a small company if it matches the following three criteria:

- A turnover below £10.2 million,

- A balance sheet total of less than £5.1 million, or

- Less than 50 employees for two consecutive years.

Although some types of entities e.g., PLCs are always required to have an audit.

The new threshold limits, set to be introduced in October 2024, follow the same conditions but at new limits. They are:

- A turnover below £15m,

- A balance sheet total/ gross assets of below £7.5m, or

- Less than 50 employees for two consecutive years.

*Time of writing 9 May 2024

For micro and medium companies, the thresholds have also changed.

Despite this, there are a number of reasons why an audit can be of benefit to your company even if it falls below this threshold.

In addition to identifying material errors or irregularities occurring in the business and delivering practical advice to improve your business, an independent and robust audit will provide assurance to you and give you credibility with your lenders about your company’s past performance. Knowing where you are today is the essential first step in creating an effective strategic plan, helping you to achieve your ambitions.

If your plan is to grow your business an audit will help you foresee if you are likely to exceed the turnover threshold in the near future, and avoid having to revisit the previous years’ figures, once the threshold has been reached

In cases where you may be planning to exit or sell your business an audit will enhance the credibility of the figures being submitted to prospective purchasers.

Whatever the objective of your business, you need to be able to rely on the financial information used to make decisions. We are able to conduct internal audits across a wide range of businesses, from pensions, charities and academy schools to local authorities and law firms. The scope may involve a broad brief to work across different functions in your organisation or an in-depth review of specific financial areas.

As audit thresholds increase, you may consider an assurance report on financial statements more suitable for your business than a full business audit. This assurance service will review the financial statements in less detail than a full audit but can be tailored to your particular needs.

Download your copy of our guide today

Download

It is important the company’s requirements are investigated fully by a competent person. The personal repercussions (including criminal proceedings) for the directors could be substantial if the regulation is not followed.