Key findings from HMRC’s latest R&D statistics

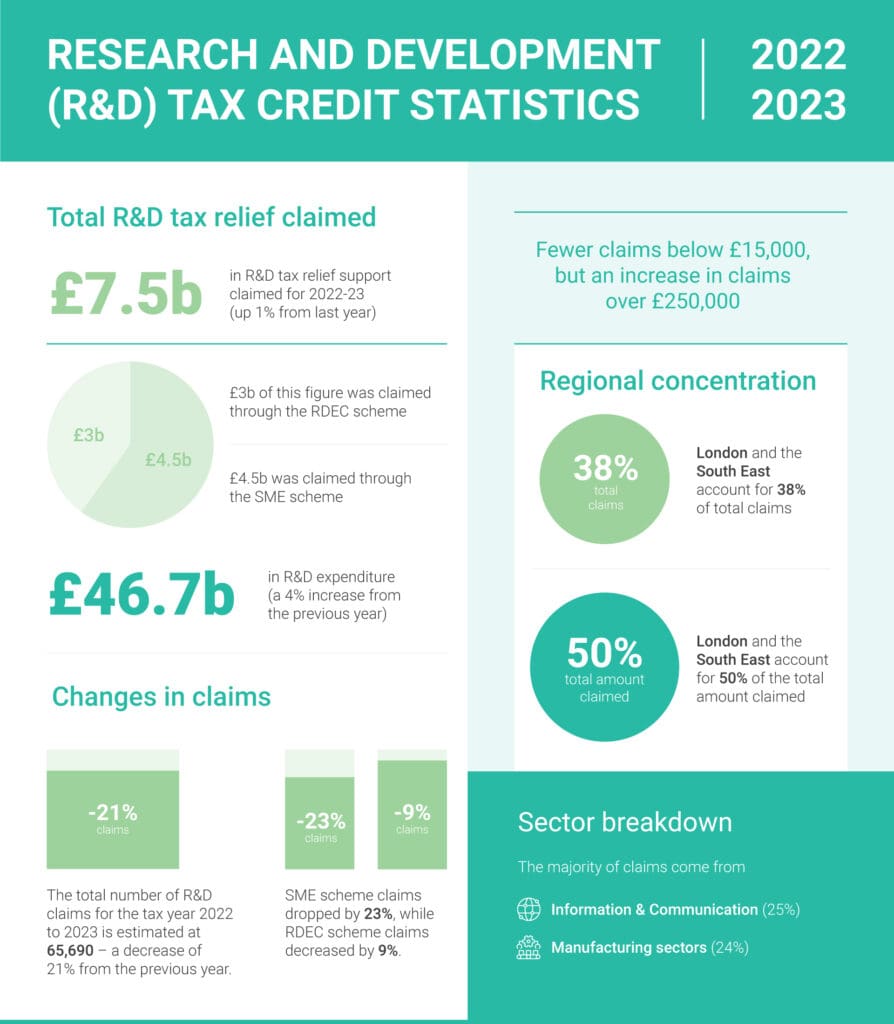

The latest data (2022-2023) from HMRC provides a revealing look into the landscape of UK Research and Development (R&D), shedding light on the number and total amount of R&D tax relief claimed across various sectors and regions.

With R&D at the heart of innovation, economic growth, and global competitiveness, these figures highlight the current state of UK innovation in addition to factors shaping its future. Where is relief concentrated? Which sectors lead the way? How are companies of all sizes engaging in R&D?

A key statistic from the latest data published by HMRC was the 21% decrease in the number of R&D claims filed for the tax year ended March 2023. The introduction of the additional information form (AIF) in August 2023 is likely to have had a significant impact on the numbers along with other administrative changes aimed at tackling abuse and improving compliance. The biggest decrease in the volume of claims related to those made under the SME scheme, which has historically been more generous and therefore a target for abuse by the most aggressive claims.

We also saw fewer claims made with tax credits up to £15,000, which is again suggestive of the increasing complexity, additional compliance requirements and enquiry risk for the smallest companies.

Gemma Thake, Tax Partner

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

We can help

Contact us today to find out more about how we can help you