Small business owners face increased HMRC scrutiny amid Labour’s tax gap initiative

As the Labour Government sets its sights on closing the tax gap, small businesses and their owners could be targeted.

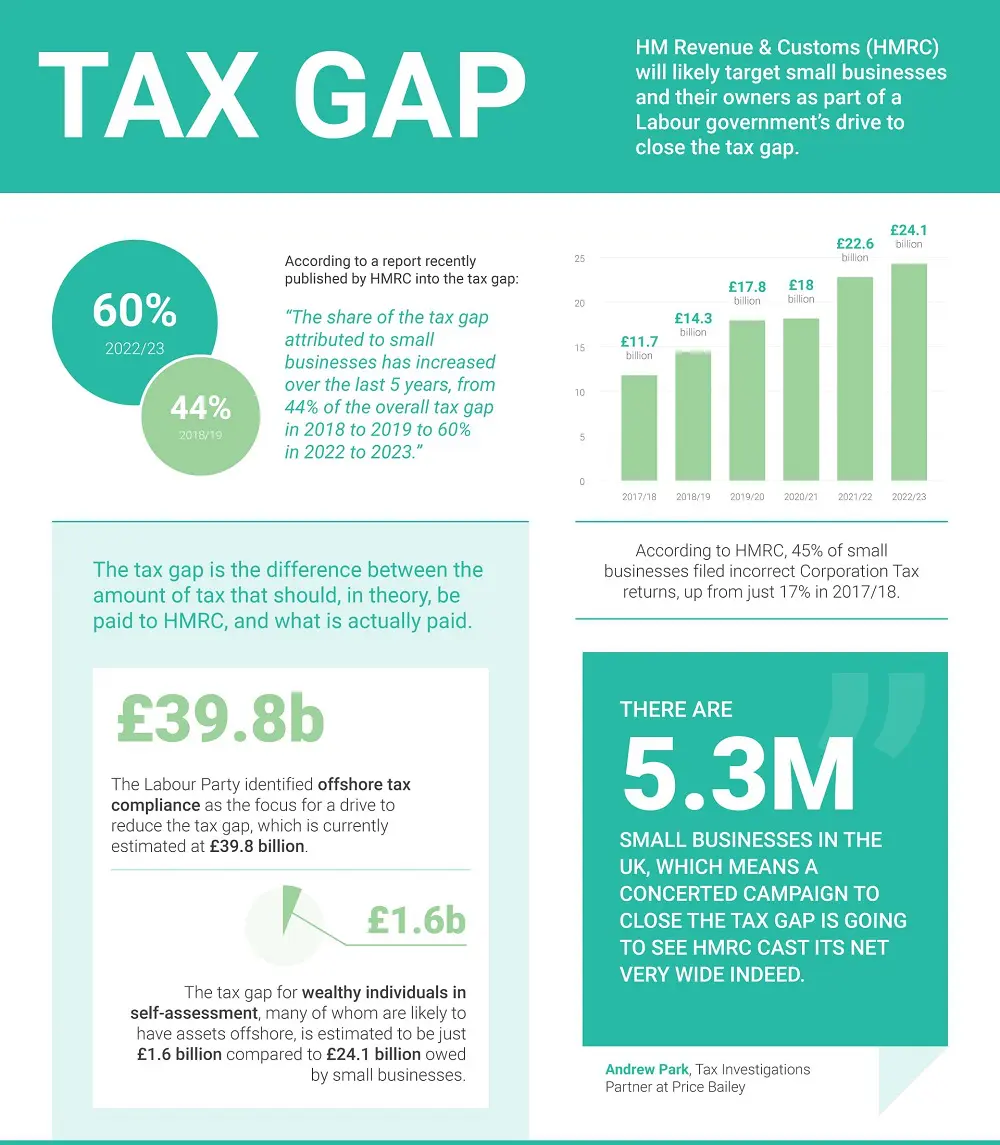

HMRC have revealed that small businesses now account for 60% of the overall tax gap, a sharp rise from 44% just five years ago. This gap, estimated at a staggering £39.8 billion, highlights the discrepancy between what should be paid in taxes and what is actually collected by HMRC.

The Labour Party plans to tackle offshore tax compliance to help bridge this gap, however HMRC has not released an estimate of the offshore tax gap alongside its 2023/24 tax gap report. Interestingly, while the tax gap for wealthy individuals who are likely to have offshore assets is pegged at £1.6 billion, small businesses face a much larger gap of £24.1 billion.

The challenge is compounded by the fact that according to HMRC 45% of small businesses submitted incorrect Corporation Tax returns—the highest rate in 16 years. HMRC is increasingly looking into multiple years of tax affairs, often launching parallel investigations into both businesses and their directors.

Given the potential for increased investigations, any small business owners who are concerned about this are advised to consider fee protection insurance. The Price Bailey Tax Investigation Service (TIS) is designed to reimburse professional costs in the event of Self-Assessment Full and Aspect Enquiries for both corporate and non-corporate clients, including enquiries into the personal affairs of directors and partners.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Have a question about this post? Ask our team...

We can help

Contact us today to find out more about how we can help you